unified estate and gift tax credit 2020

Instead all of those funds pass directly to the specified recipients. You can give up to this amount in money or property to any individual per year without incurring a gift tax.

Solved Gabriel Had A Taxable Estate Of 8 4 Million When He Chegg Com

The unified estate and gift tax credit exempts people with taxable estates under 117 million from paying any estate taxes at all.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

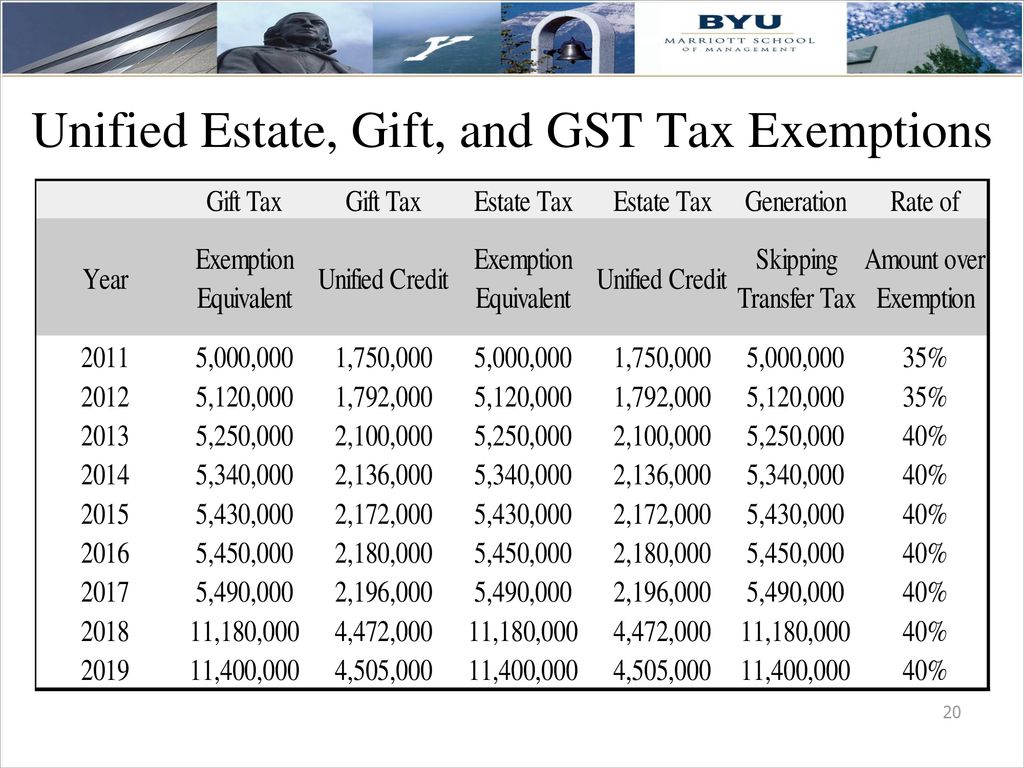

. The previous limit for 2020 was 1158 million. Income Tax Fundamentals 2020. For 2022 the lifetime gift and estate exemptions increased to 1206 million per individual and 2412 million for married couples.

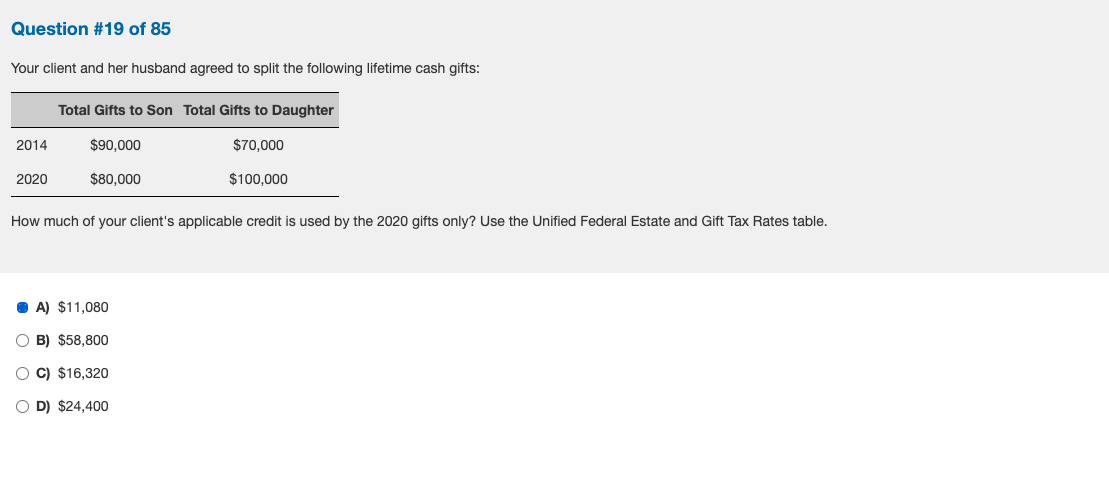

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. The remaining 30000 could then be applied to your unified tax credit reducing it to 1167 million. The annual exclusion amount for 2020 is 15000 per person.

It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. A problem occurred. Then you take the 1158 million number and figure out what the estate tax on that.

Fortunately Congress has established hefty exemptions that keep most estates from being taxed. It consists of an accounting of everything you own or have certain interests in at the date of death. What is the unified credit for estate and gift taxes.

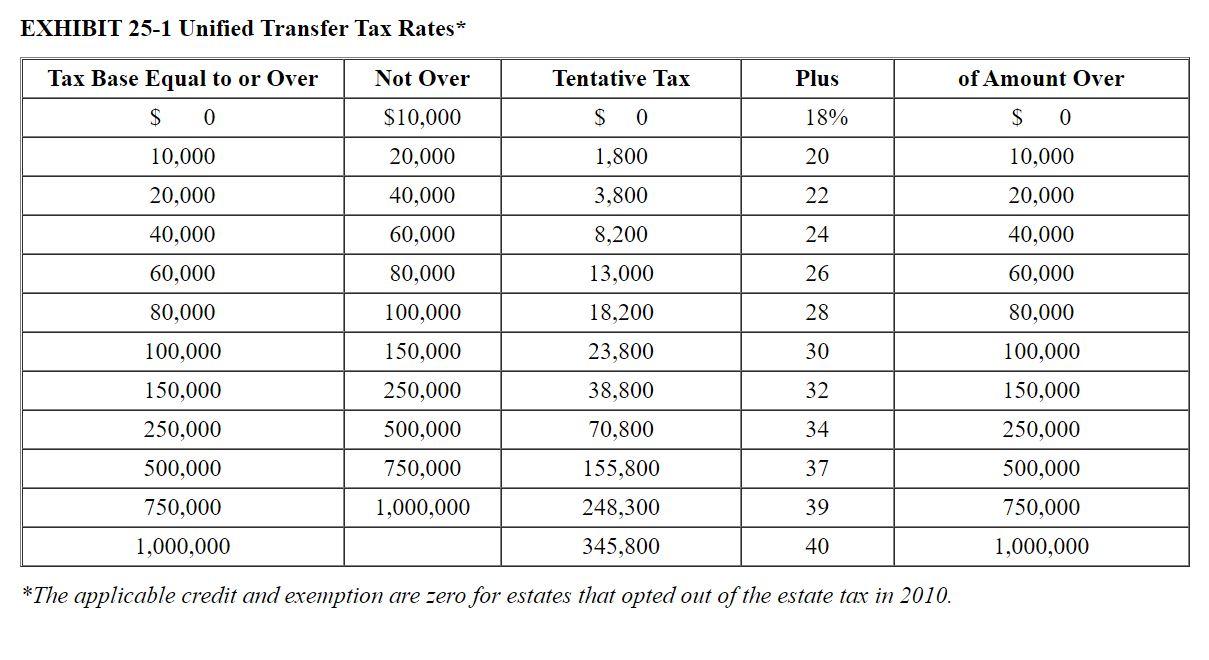

So if someone left a 15 million estate only 294 million of it would be subject to the 40 percent tax. Estate Planning 2017 2018 2019 2020 Annual Gift Tax Exclusion 14000 15000 15000 15000 Annual Gift Tax Exclusion to a Noncitizen Spouse 149000 152000 155000 157000 Applicable Exclusion Amount. In other words use it or lose it.

The unified tax credit integrates both the gift and estate taxes into one tax system. The lifetime gift tax exclusion was expanded under the Tax Cuts and Jobs Act and with an inflation adjustment in 2020. This is called the unified credit.

Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. The Internal Revenue Service announced today the official estate and. The unified credit against estate and gift tax in 2022 will be.

Should the exemption be set higher. A married couple can transfer twice that amount to children or others or 228 million. This is called the unified credit.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. The internal revenue service irs just announced that the estate and gift tax exemption for 2020 is increasing to 1158 million per person up from 1140 million in 2019. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021.

Gifts and estate transfers that exceed 1206 million are subject to tax. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n. Gift Tax 5490000 11180000 11400000 11580000 Estate Tax 5490000 11180000 11400000 11580000 Applicable Credit Amount.

The recipient typically owes no taxes and doesnt have. For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. For 2021 that lifetime exemption amount is 117 million.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Whether you choose to give monetary gifts during your lifetime or want to simply leave your estate behind when you die the unified tax credit lets you and your loved ones avoid some additional taxes. When an estate is below the unified gift and estate tax credit limit there will be no estate tax due at the time of death.

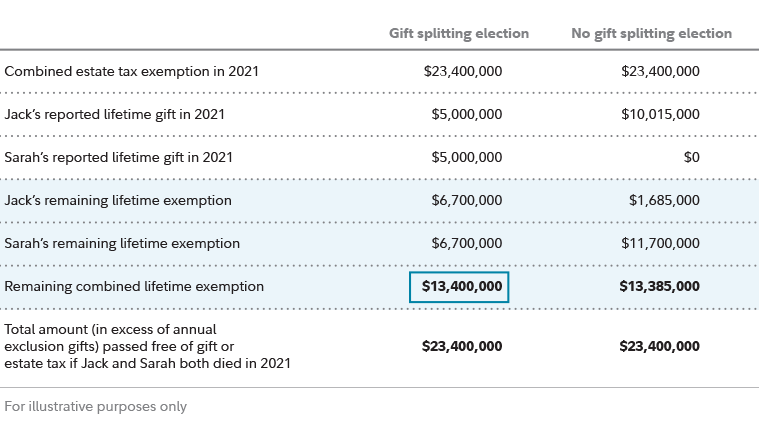

The unified credit is per person but a married couple can combine their exemptions. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount.

Gift and Estate Tax Exemptions The Unified Credit. Estate and Gift Taxes. The Unified Tax Credit Individuals who gift large amounts while still living may be required to pay the gift tax and assets left to beneficiaries may be subject to estate tax.

Under the tax reform law the increase is only temporary. This credit combines both gift taxes and. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million.

Try refreshing the page. The estate tax is a tax on your right to transfer property at your death. Expert Solution Want to see the full answer.

Learn about the COVID-19 relief provisions for Estate Gift. Check out a sample QA here See Solution star_border Students whove seen this question also like. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Then there is the exemption for gifts and estate taxes. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

Find some of the more common questions dealing with basic estate tax issues. The previous limit for 2020 was 1158 million. Thus in 2026 the BEA is due to revert to its pre-2018 level of 5 million as adjusted for inflation.

A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. For 2021 the estate and gift tax exemption stands at 117 million per person.

The tax is then reduced by the available unified credit. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. The estate and gift tax exemption for 2021 is 117 million.

The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate dollar for dollar.

Gift Tax Exclusion Essential Info Understand The Unified Credit

Tax Related Estate Planning Lee Kiefer Park

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

History Of The Unified Tax Credit Apple Growth Partners

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Solved Suppose Vince Dies This Year With A Gross Estate Of Chegg Com

Personal Finance Another Perspective Ppt Download

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Question 19 Of 85 Your Client And Her Husband Agreed Chegg Com

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Irs Alert Update New 2020 Federal Estate Gift Tax Limits Announced By The Irs David M Frees Iii

Estate Planning Strategies For Gift Splitting Fidelity

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition